Excerpt: Giant Shifts by Jimmy Vallee

Silicon Bayou: Harnessing the Future of Oil and Gas Technology

We can’t ignore the expense of technology development and implementation, but the long term gains far outweigh the upfront expenses. As history has shown, it takes time for the oil and gas industry to adopt new technologies. Having said that, once a new technique is shown to work, it rapidly becomes industry standard. Result? A billion dollar business.

In moving forward, oil and gas companies need to focus on areas that serve the industry and society, and not solely the company. Technological innovation in oil and gas isn’t about exclusivity. If your strategy is successful, others will bring it onboard. The transformation of the industry starts gradually, but once it takes off, it really takes off, and the revenues are enormous.

There are several areas of investment that pack the biggest punch when it comes to impacting short-term oil and gas industry costs. The secret to pulling the maximum potential return on technological innovations is for companies to hone in on the projects that best target the most significant cost categories within their asset portfolios.

An obvious jumping off point involves bringing down the cost of operations and capital expenditures by cutting staff. Oil companies can reduce capital expenditure by three to fifteen percent and cut operational costs by up to seventy percent by integrating automation and remote operation networks1. Future facility design then follows suit to reflect the lower staff levels.

Areas of high repetition involved with well construction, drilling and other field associated activities is another good place to start. The incredible expansion in recent shale oil and gas resources has resulted almost directly from a continuous improvement in drilling and well completion strategies. Just take a look at the drilling efficiency in the Eagle Ford Shale in the last five years, an increase of nearly one-hundred and fifty percent.11 We need to develop and deploy the technologies that can complete those tasks on their own.

Big data analytics is going to be necessary to collect all of the information that's being developed by advanced seismic techniques and remote metering to sift through the unprecedented amounts of data. That data has to be analyzed and acted on. It will require advanced data capture and storage technology and sophisticated software development that will continue to become increasingly important to evaluate that data and understand its significance.

We need to reduce subsurface uncertainty and devise methods to better handle the remaining uncertainty. BP recently invested in the development of advanced acoustic telemetry with XACT Downhole Telemetry, Inc., to help measure the temperature, pressure and fluid composition 20,000 feet below ground. BP was the first user of the zero-revenue company’s application. XACT Downhole Telemetry is now going to be a two to three billion dollar asset. Each time BP uses the product - each time - they are saving between twenty and thirty million dollars2.

It’s more comprehensive than just investing in research and development (R&D). What we need is education - education starting at the middle school level - about the integration of technology in our industry. We need to foster a cultural change, to nurture a Silicon Valley-driven environment right here in Houston, Texas – “Silicon Bayou.” A centralized area where the oil and gas industry can reinvest in itself.

Perhaps the single most important task of Gen X-ers in the oil and gas industry today is to act as stewards in the “great crew change.” We are responsible for narrowing the gap between the boomer’s knowledge base and the millennials’ Silicon Valley mindset. We must become the universal communicators between the two driving generations, appealing to what is important to the boomers, and handing those ideas down.

The millennials’ expectations are in climate change and corporate responsibility. Their consumption of technology and content is voracious. It is something that has never been seen before. Their insatiable demand for immediate solutions and analysis is going to drive major fundamental changes in our business. They will probably tear down the very formats and cultures of our current oil and gas industry, only to rebuild them into a socially networked and technology-driven industry, leading to higher level efficiencies that we’ve never even dreamed were possible.

Oil and gas is still a people-centered industry at heart. It takes a sharp intellect honed by years of experience to learn the field, and it’s going to require a surge of human imagination and ingenuity to develop the new technologies that are going to solve our future challenges and alleviate current ones. In the end, the real driving force will come from the creative minds of our workforce - whose minds, initiative and visions are going to drive these tectonic shifts.

The Geopolitics of Oil

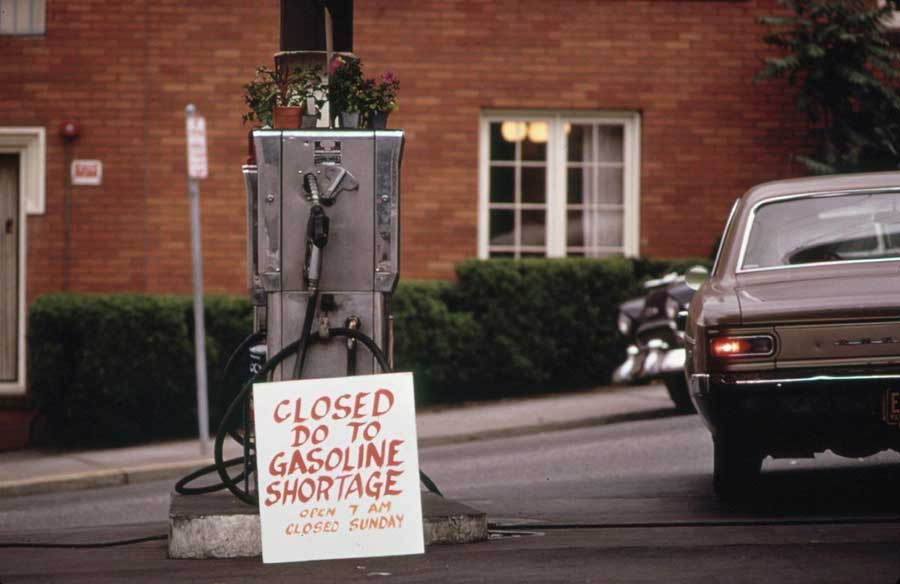

As people go about their everyday lives in our modern twenty-first century metropolises, few of them ever stop to think about the effect that the complex shifts taking place in the international oil market has on their lives. I have vivid memories of waiting in long lines with my parents to fill the tank of their car when I was growing up in the 1970s. I had no idea what was going on, and while the effects of the Arab world´s oil embargo on America may have been visible all over the country, even then, few common people had any inkling of just how profound the effects of the geopolitics of oil were on their lives – and they still are.

After all, if I am living in a little town in America, how can oil wars in a distant part of the world affect me personally? The truth is that they do, and they continue to be among the most consequential geopolitical issues in today´s world. As new exploitation techniques grant us access to as yet untapped oil deposits and the political and economical map of the world undergoes major transformations, the geopolitics of oil has become an increasingly dynamic field for research and analysis.

In the early days of oil exploitation in America, the price of a barrel dropped from ten dollars to ten cents in only a year, land that had sold for hundreds of dollars was valued under ten dollars after the oil had been exhausted through bad engineering practices. While changes in oil prices in our day may seem less dramatic, they continue to have massive effects on national and international security, economic growth expectancy, and political stability.

The geographical patterns of energy production, transit, and consumption across the globe form the complex architecture of energy security. The International Energy Agency (IEA) has predicted that energy demand will rise by over thirty percent by 2035, due to the increasing development of emerging economies, among other factors.

In the past, the West´s energy needs have shaped that global landscape, but the population growth in some key regions is changing that. In 2013, China became the world´s biggest oil importer. As of May 2016, the US is back at the top of the list, but still followed closely by the Asian superpower.

The shale revolution has empowered America with a sudden, unforeseen oil and gas output capacity. Meanwhile, OPEC has utilized different strategies to try to stay in control of global crude oil pricing, and, arguably, contributed to its potential irrelevance.

In order to understand how the architecture of energy security works, it is necessary to look back at all the substantial shifts that brought us to where we are today. In my view, the future holds tremendous opportunity, and what may now be perceived as setbacks or competitive disadvantages, may soon enough reveal themselves as blessings in disguise.

1. The Formation of OPEC - 1960

The Organization of Petroleum Exporting Countries (OPEC) was formed in Baghdad in 1960. Dissatisfied with Western companies` control over oil prices, top oil producers, Iran, Iraq, Saudi Arabia, Kuwait, and Venezuela decided to join forces in an attempt to gain control over a variable that had a dramatic impact over their national economies. By 1973, OPEC had expanded to include seven more members. The oil production of OPEC countries by then amounted to two thirds of the world´s oil production.

OPEC itself defines its objectives as follows, “to co-ordinate and unify petroleum policies among Member Countries, in order to secure fair and stable prices for petroleum producers; an efficient, economic and regular supply of petroleum to consuming nations; and a fair return on capital to those investing in the industry.” As it is the case with many a lofty mission statement, these noble pursuits are sometimes less noble than they sound.

At the time of its inception, however, OPEC may have had some worthy objectives. Before the discovery of oil reservoirs across the Middle East; Kuwait, Iraq, Iran, and Saudi Arabia were extremely poor nations.

In Iran, formerly Persia, “the peasants, who constituted the build of the population, made their living by farming on land generally belonging to an absentee landlord. They lived in small mud villages close to a subsistence level, the unfortunate victims of ignorance, disease, and poverty.”3

The major multinational oil companies which dominated the landscape at the time saw the opportunity in these impoverished lands with massive resources, which they were economically and technologically incapable of exploiting by themselves.

Thus, contracts for as long as 60 years were signed that gave exclusive rights to oil companies to drill, extract, and commercialize the oil that could be found across some of the world´s largest petroleum reserves. Some contracts gave a single company exploitation rights for the whole territory of a country. As a whole the contracts were largely favorable to the multinationals, and this eventually created a fertile ground for the development of OPEC.

As several oil producing countries began to nationalize their oil resources, the multinationals, five of which were American (Chevron, Exxon, Gulf, Mobil, and Texaco) lost their superpowers to control the oil market, and OPEC started calling the shots. As a result, the economies of OPEC countries received an unprecedented boost from oil money, with positive effects on their industrial development, albeit largely maintaining social inequality.

2. Arab Oil Embargo and Oil Shocks - 1970s

In 1973, as US oil production was in a phase of decline, and global industrialization prompted a peak demand, OPEC saw an opportunity to increase crude prices. But the oil crisis than ensued was further complicated by the involvement of the US in a conflict between Arab OPEC countries and Israel.

As the US supported Israel in the Yom Kippur War, OPEC placed an embargo on both the US and the Netherlands, a country that was also an ally of Israel. The combination of high oil prices and the effects of the embargo proved disastrous for the US and the Western world as a whole. In the beginning, oil exports from OPEC countries to the US were only restricted, but after the Yom Kippur War broke out in October 1973, Iran and several Arab nations cut off these oil exports altogether, leaving the US to fend for itself, trying to satisfy its large demand with its own dwindled supply and little else.

The long lines my parents and I experienced at the gas stations were a testimony to OPEC´s power, more than anything the world had seen before. The shortages drove prices even higher and, by the end of the embargo in March 1974, the price of oil had gone from $3.50 to over $12 per barrel in less than two years.

3. U.S. Crude Oil Export Ban - Establishment of Strategic Reserve

The U.S. pioneered oil production and consumption beginning as early as the 19th century. Domestic crude made America energy independent through the first half of the 20th century. In 1929, the U.S. imported roughly 79 million barrels, while exporting 26 million. But in fact, America´s oil production in 1929 was a staggering 1 billion barrels. U.S. oil production at the time was largely focused on internal consumption.

By 1938, exports reached 77 million barrels and imports were reduced to 26 million. Meanwhile, production was safely at 1.2 billion barrels. In the light of that domestic output, oil´s import/export balance played a rather insignificant role.

In the years following WWII and preceding the 1973 Arab oil embargo, the U.S. implemented a number of measures to try to protect domestic oil from the competition of cheaper oil from the Middle East. There were partial export bans, import quotas, and domestic oil subsidies. But it cost 20 times more to produce oil in the U.S. than in, for example, Saudi Arabia, and the policies were unable to stop the rise of Middle Eastern oil.

In the early 1970s, the dwindling U.S. oil supply, Nixon´s lift of import quotas, and the coup de grace of the Arab oil embargo, cornered President Ford into signing the Energy Policy and Conservation Act (EPCA) to try to control domestic demand. At the same time, the legislation gave the President the right to ban crude oil exports. Because only 2 million barrels had been exported in 1974, when the U.S. consumed roughly 6 billion, the export ban would have very limited effects.

EPCA also instituted the Strategic Petroleum Reserve, an oil storage network that was filled with oil in 1977 and will remain usable through 2025. The idea of storing oil to prepare for an emergency was nothing new. Back in 1944, Interior Secretary Harold Ickes had suggested a similar strategy, and so did Truman, Eisenhower, and the Cabinet Task Force on Oil Import Control at different points in history.

The bigger picture goal was to make America less reliant on oil imports. In order to achieve this, the national speed limit was set at 55 miles per hour to reduce demand, and the International Energy Agency was founded. The new organization´s objective was to analyze and predict global trends in oil supply and demand, so that the U.S. could anticipate them and minimize potential negative impacts.

EPCA also gave the President the prerogative of establishing exceptions to the export ban on crude oil. Thus, in the decades that followed the policy´s implementation, the U.S. continued to export low volumes of crude. Recent U.S. oil exports, prior to the lifting of the ban in December 2015, have been focused mainly on Canada. It is important to mention here that the ban did not affect petroleum products, of which the U.S. has maintained a steady export flow, which reached 3.8 million barrels per day in 2013.

In retrospect, it is hard to affirm that the ban achieved its original goals. While crude imports dropped through the late 1970s and early 1980s, they went on to rise dramatically later. In spite of a restrictive policy that spanned 40 years, the U.S. has remained rather vulnerable to global fluctuations in oil pricing. As the lifting of the ban was being discussed in 2015, many analysts argued, I believe with good reason, that the ban had never been a game changer in the first place.

4. Collapse of the U.S. Oil Market in the 1980s (fall out of Savings & Loans)

Over 30 years have gone by since the 1986 oil bust, and we have seen a similar scenario emerge in our industry over the last few years. Like then, today´s global markets are oversupplied with crude. Meanwhile, OPEC is eschewing its swing producer role in an attempt to salvage its market share in the post-shale revolution landscape. Besides the fact that the earlier crash mainly affected the U.S. and the recent crash is global, it is precisely the shale revolution that makes the two crises dramatically different, because non-OPEC countries are in a very different position today in terms of their ability to satisfy their own energy demand.

The 80s followed a very robust period for the US oil and gas business. New fields had been found. For example, the mid-continent oil fields were found in Oklahoma as well as in many other areas. Domestic supply rose rapidly due to all the exploration and production activities that developed in the late 70s.

Before the Arab oil embargo the price of oil was determined mainly by the Texas Railroad Commission and the Seven Sisters4. The 1973 price increase restricted global economic growth, but it was not until a second price leap in 1979 that this seriously affected OPEC´s market share.

Those high oil prices were a response to the Iranian Revolution´s resulting output loss. The global recession that ensued cut back oil demand, allowing prices to plummet. Supply was also increasing on account of new producing regions like Mexico, Alaska, and the North. Meanwhile, Saudis were adamant on hurting the U.S.S.R.´s interests after the world power´s 1979 invasion of Afghanistan. Thus, Saudi Arabia boosted production in order to drive prices down and deprive the Soviet Union of coveted U.S. dollars from oil exports.

The crisis was also disastrous for the world´s oil reservoirs as only low-cost drilling remained profitable at such low oil prices. Many wells across the U.S. were abandoned as a consequence. In late 1985, there were about 2,300 active wells in America. Within only a year, that number had been reduced to 1,000.

That context gave way to a massive economic crisis, driving unemployment in the oil sector as well as connected service providers out of businesses, such as drilling equipment manufacturers and transportation companies. In Texas, unemployment had consistently been lower than in the U.S. as a whole for decades, but during the crises, it became higher for the first time.

The shock spread over into the savings and loan industry, which was based on loans that collateralized by real estate development. Because those real estate developments were often being driven by money connected to the oil business, when the oil business collapsed, the real estate market collapsed too, and the savings and loans that were built on it collapsed as a consequence. The 1980s crises inaugurated a period of low oil and little exploration and production activity, which would continue well on into the turn of the 20th century.

5. Industrialization of Non-OECD countries, Rise of China - Commodity "Super Cycle"

The late 1990s initiated a period of industrialization around the developing world. Non-OECD countries, particularly China with its significance in terms of production and consumption capacity gave way to a new phenomenon which is known as the commodity super cycle.

Much like the post-WWII economic boom, the commodities supercycle boosted demand and drove the prices of several commodities upwards, including, prominently, the much-needed oil to fuel the industries of many increasingly industrialized countries. Oil demand from emerging countries rose spectacularly, in spite of some short-lived slumps, for a decade, beginning around 1992.

Footnotes:

- BP Technology Outlook. (2015). Retrieved from http://www.bp.cmo/content/dam/bp/pdf/technology/bp-technology-outlook.pdf.

- Issam Dairanieh. (2015, May). Big Data, IoT & Cloud: Game Changers in the Oil & Gas Industry. TiEcon 2015 Conference, Silicon Valley, CA.

- Stocker, George W. Middle East Oil: A Study in Political and Economic Controversy. Kingsport, Tennessee: Vanderbilt University Press, 1970, 4.

- “Seven Sisters” was a term that came about in the 1950s describing the seven major oil companies that controlled around 85% of the world’s petroleum reserves: Anglo-Persian Oil Company (now BP); Gulf Oil; Standard Oil of California (now Chevron); Texaco; Royal Dutch Shell; Standard Oil of New Jersey; and Standard Oil Company of New York.

- Chart created by Tom Thehand, Wikimedia Commons